Property

Our international property facultative business has been growing robustly for several years in a row. In 2022, we achieved both growth and profitability with a more strict and conservative underwriting approach in a buoyant rating environment. We saw our gross written premiums increase from KRW 137.6 billion in 2021 to KRW 154 billion in 2022, with our combined ratio before management expenses staying at 84.8% in 2022.

We take great pride in the profitable growth we have delivered over the last few years based on our strategic efforts to take customized approaches to underwriting for different regions. We have also continuously tightened our underwriting guidelines to minimize exposure in catastrophe-prone areas, while also securing fair improvements in terms and conditions.

A hardening phase in the insurance market cycle has continued and even developed further across the board, allowing for a continuously favorable pricing environment, but what made UY2022 distinctive was that market cycles varied by region. Thus, we concentrated on geographically diversifying our Asia-based portfolio, with vast improvements in terms and conditions in North America, Europe, the Middle East and Africa. On the other hand, Asia enjoyed benign claims records, and no major changes in terms and conditions were made for the region in 2022.

This portfolio restructuring that we have sought over the past years also helped us maintain a solid growth trajectory. Although Asia remains dominant in our business portfolio, we have strived to expand into new markets and to build a more balanced portfolio.

The expansion of business has been backed by rigorous risk assessment, which has enabled us to identify the target markets that provide the most profitable growth opportunities.

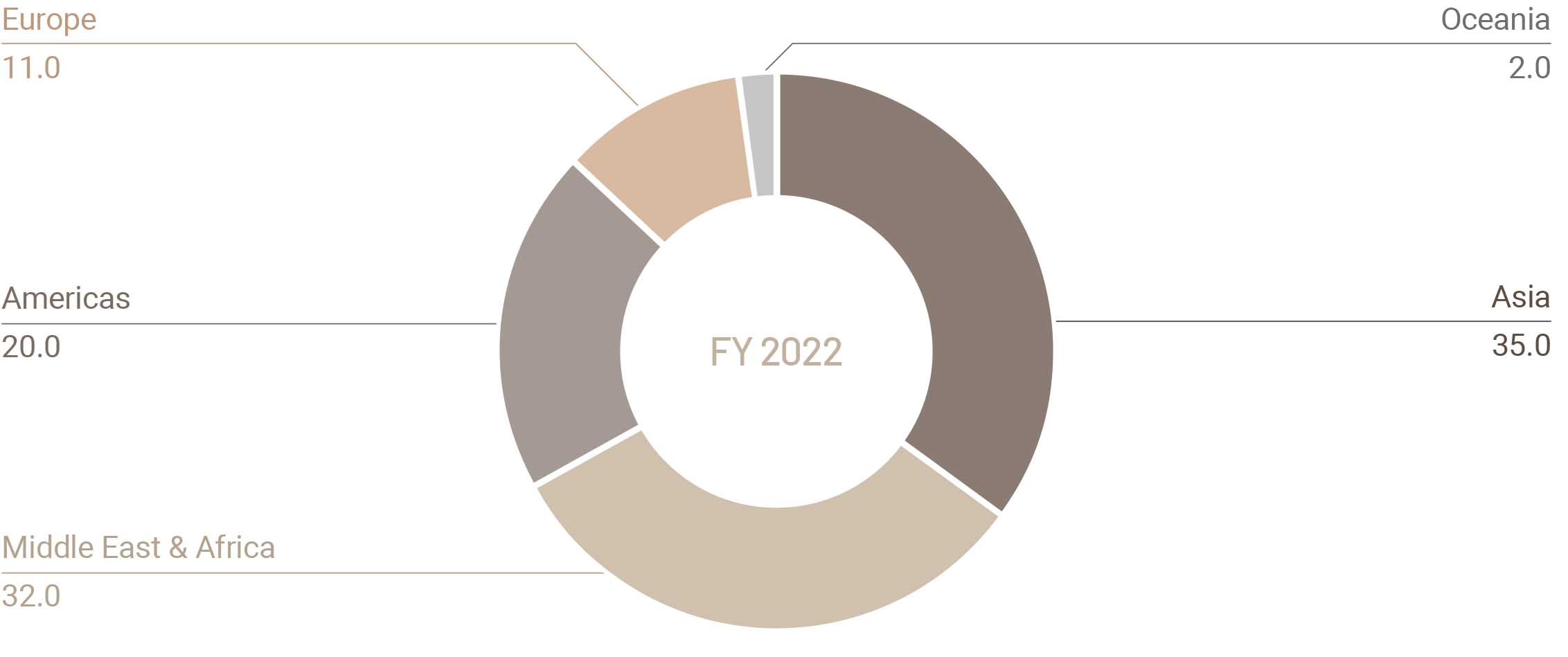

In terms of premium breakdown by territory, Asia took up the largest share (35%) of our entire international property facultative portfolio in 2022, which was down from 46% in 2021. It was followed by the Middle East & Africa (32%), the Americas (20%), and Europe (11%).

In 2022, power risks enjoyed a double-digit year-on-year increase in gross written premiums even with a fewer number of accounts. Industrial risks also had a fair increase in premiums, whereas commercial and energy risks remained at a similar level to 2021. Our portfolio diversification by region and occupation was backed by stringent risk assessment and modelling. We have been taking a conservative approach to high-risk occupations as well as risks vulnerable to inflation.

With tightened treaty terms and capacity, we have been experiencing a raft of good opportunities in providing facultative covers in 2022-2023. However our underwriting will be strictly based on thorough risk reviews, and capacity deployment will continue to concentrate on Non-Nat Cat coverages. The current firming of the reinsurance market will likely persist throughout 2023, and favorable pricing momentum will have a positive impact on both business growth and underwriting margins.

We have been facing headwinds not only from the pandemic but also from catastrophic losses and possible regulatory hurdles or changes. In other words, the path ahead may not be necessarily an easy one to navigate, but we will remain committed to supporting our clients on the back of our strong credit ratings and capacity, as well as our underwriting expertise and experience. These are the very strengths that have been at the core of our business success and will remain the bedrock of our long-term growth.

International Facultative Portfolio by Region in 2022 (Property)

(Units: %)

Gross Written Premiums: International Property Facultative

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| International Property Facultative | 154.0 | 118.5 | 137.6 | 119.7 |

Engineering & Construction

Korean Re maintained positive growth momentum with its international engineering and construction facultative business, showing a year-on-year growth of 5.2% in 2022. This top-line increase was supported by improving market conditions, as rate hardening trends have dominated the market since 2020. Rates have increased, and terms have tightened, indicating a green light for insurers’ profitability. The global construction industry has also experienced solid growth, especially from U.S. and European investments in infrastructure. Although there were some concerns that inflation might put a damper on investment decisions with regard to various construction projects, the global construction market is making a solid recovery from a pandemic-triggered slump.

In 2023, the market is set to continue growing, with many delayed projects expected to resume once again as global supply chains stabilize. Environmentally efficient construction methods and renewable energy projects are also gaining traction due to ESG drives. As regulations and the economics of green technologies are quickly evolving, the renewable energy sector will become more prominent as an alternative means to meet people’s energy needs.

In line with this market outlook, we are expected to be on a similar growth trajectory in 2023. In order to produce sound and sustainable business results, we will respond nimbly to any market changes and stay committed to developing and strengthening our long-term relationships with many strategic partners and key clients across the globe. In addition, we will proactively execute portfolio management by regularly monitoring early signs of loss ratio deterioration and natural catastrophe exposures.

Gross Written Premiums: International Engineering & Construction Facultative

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| International Engineering & Construction Facultative | 89.5 | 68.9 | 85.1 | 74.0 |

Marine & Energy

A marine market boom worldwide seemed to continue into 2022, but proved to be short-lived. Faced with inflation and the fear of an economic recession, the marine market took a downturn in the second half of the year. The upstream energy market has been showing moderate growth for three years in a row since 2020, marking a turnaround from year-on-year contractions in market premiums from 2014 to 2019.

In 2022, our international marine and energy business achieved robust growth, with gross written premiums increasing by 11.7% year on year to KRW 53.3 billion. As part of an initiative to embrace the carbon-neutral movement in our business, we expanded our portfolio to include risks related to wind turbine installation vessels and offshore windfarms. Based on our strict and profit-oriented underwriting discipline, we made great efforts to improve the terms and conditions of the coverage provided and realized a healthy technical profit of KRW 6.6 billion before administration expenses.

With global oil and gas prices expected to remain high in 2023, we foresee the construction insurance market for upstream energy development projects to grow this year. Against the backdrop of strong ESG drives worldwide, the market for offshore windfarms is also forecast to grow. However, as there is sufficient capacity in the market with no significant market loss experience last year, we expect flat renewals on average. To grow our international marine and energy business, we are taking steps to tap into a fast-growing offshore windfarm sector as the market becomes more disciplined in response to the evolution of new technologies. We are confident that we can seize on energy transition as a new source of growth opportunities that will translate into stable profitability.

Gross Written Premiums: International Marine & Energy Facultative

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| International Marine & Energy Facultative | 53.3 | 41.0 | 47.7 | 41.5 |