Note: This section covers business results for the head office only.

Review of Operations

Note: This section covers business results for the head office only.

Domestic Property

In 2022, the Korean property insurance market was considerably impacted by Typhoon Hinnamnor, resulting in its largest single natural catastrophe (Nat Cat) loss at POSCO. Along with the significant impact of the typhoon, the market suffered several midsized Nat Cat losses and man-made fire losses throughout the year. As a result, the loss ratio of the domestic property market remained high for three consecutive years, reaching over 90% in 2022.

In light of the high loss ratio, the trend of ceding insurers reducing their retention levels in Korea continued in 2022. They are now relying more on reinsurance capacity, giving rise to the hardening of premium rates and the tightening of underwriting guidelines. Following years of increases, their average retention ratio has been falling since 2020 when insurers encountered a series of substantial losses, such as fires at Lotte Chemical and LG Chemical. The ratio fell below 40% in 2022 from 42.3% in 2021 and 46.1% in 2020.

In contrast to overseas markets, which have been in a hardening cycle for several years, the Korean property insurance market has only been hardening since 2020 when the market loss ratio soared. In 2022, however, premium growth for medium-sized accounts was impeded, with some experiencing weak or even negative growth.

This was due to fierce competition among primary insurers for market share, using so-called “judgement rates.” A judgement rate is one that primary insurers produce themselves by using their own statistics, and it is usually utilized for small and medium-sized accounts when a primary insurer intends to retain most or all of the risks with its own capacity.

In the face of this market condition, Korean Re achieved strong growth across most lines of property insurance, backed by the current favorable rating environment and greater dependency of primary insurers on reinsurance support. Our domestic property business saw its premium income jump by 6.7% to KRW 652.1 billion in 2022. Gross written premiums from comprehensive insurance increased by 5.6% to KRW 422.6 billion, while premiums from fire insurance decreased by 7.7% to KRW 111.9 billion. We also recorded a spike in business from our Korea Interest Abroad (KIA) accounts, with premiums soaring by 32.6% to roughly KRW 111.2 billion.

Our underwriting performance in domestic property (including KIA) remained resilient in 2022 after bouncing back in 2021 from a sharp setback in 2020 when we had been hit by a number of large losses from man-made disasters like explosions at chemical plants and natural disasters, such as Typhoon Maysak. Although we managed to maintain technical profitability, the combined ratio before management expenses increased by 3.4%p to 93.2% in 2022 due to Typhoon Hinnamnor and several other losses.

In 2023, market hardening is likely to continue, especially with respect to the mega risks which rely more on overseas capacity. Disappointingly, however, we expect premium rates to slightly decrease for small and medium-sized accounts because competition remains high for market share among primary insurers.

As in previous years, we will continue to resist undercut policies in terms of pricing or ones that do not fit with our underwriting guidelines. In particular, we do not accept any policies that are based on judgement rates in our inward treaties, as they do not meet our underwriting guidelines.

For treaty renewals in 2023, we have strictly maintained our underwriting discipline by restricting reinsurance terms and conditions, and reducing cession ranges and commission rates, as well as minimizing exposure to risks that are sensitive to economic downturns, including warehouse and factory fire policies. As we focus on building a profit-oriented portfolio, we will continue to take a highly disciplined approach to underwriting and remain selective about risk acceptance and pricing.

Gross Written Premiums: Domestic Property

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| Fire | 111.9 | 86.1 | 121.3 | 105.5 |

| Comprehensive | 422.6 | 325.1 | 400.2 | 348.2 |

| Korea Interest Abroad (KIA) | 111.2 | 85.6 | 83.3 | 72.9 |

| Nuclear Insurance* | 6.4 | 4.9 | 5.9 | 5.1 |

| Total | 652.1 | 501.7 | 611.2 | 531.7 |

* Nuclear insurance includes overseas business.

Korea Atomic Energy Insurance Pool (KAEIP)

In Korea, nuclear risks are insured by the Korea Atomic Energy Insurance Pool (KAEIP), which is managed by Korean Re. With 12 member companies, KAEIP is a voluntary, unincorporated association. On behalf of its members, we support the operation of KAEIP based on our expertise in risk management and underwriting so that the pool can provide risk transfer solutions to the nuclear industry that would otherwise be unable to obtain insurance coverage. The pool jointly underwrites domestic and international nuclear risks.

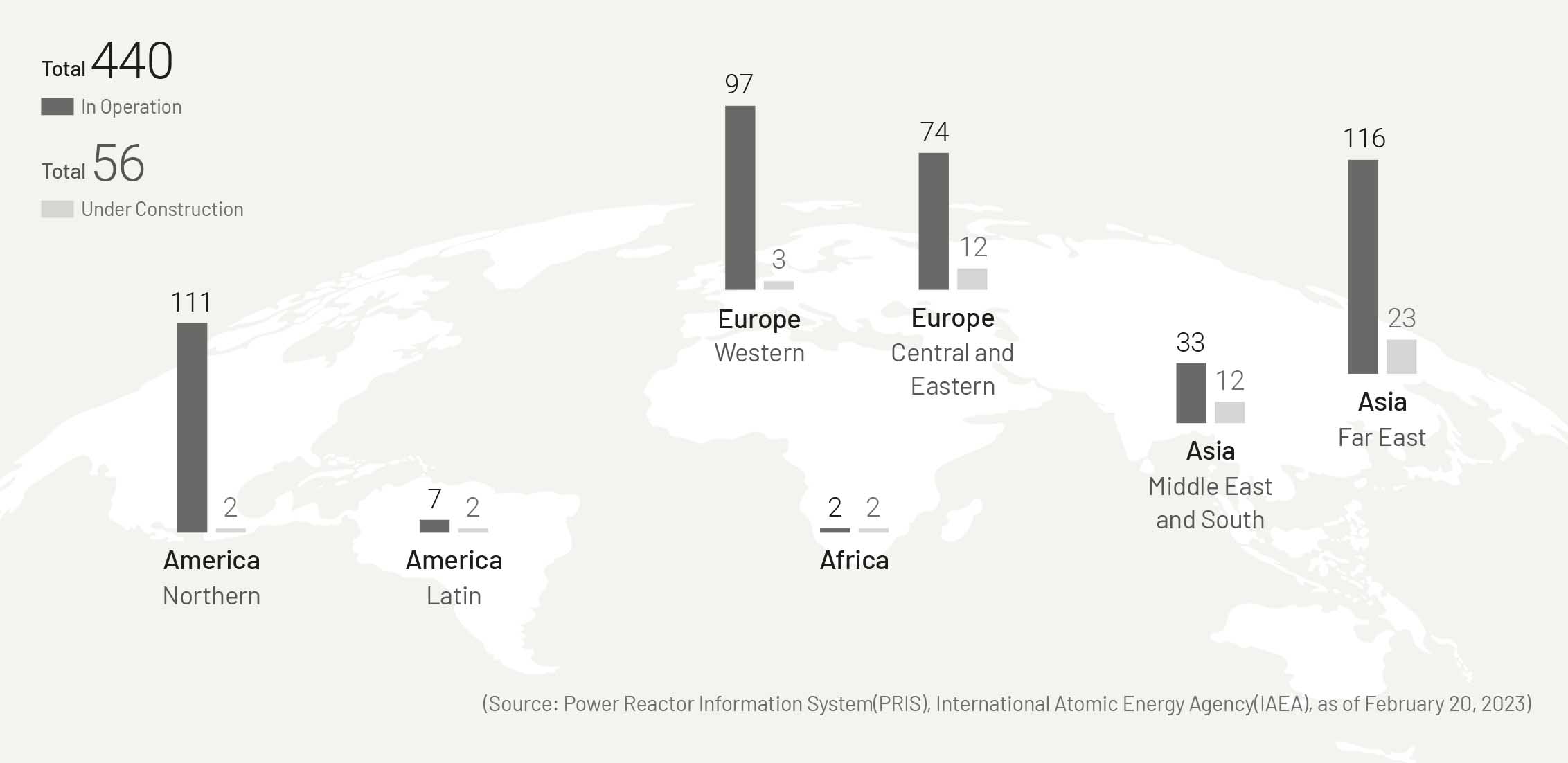

There are 27 nuclear power plants (NPPs) in Korea, with 25 NPPs in operation and two NPPs permanently shut down (Kori Unit 1 in June 2017 and Wolsong Unit 1 in December 2019). At present, three additional units are under construction. Globally, a total of 440 reactors are commercially operational, and 56 reactors are currently being built. Major countries with nuclear reactors under construction are China (18 units), India (8 units), and Russia and Turkey (4 units each).

In 2022, KAEIP achieved growth both in domestic direct and international reinsurance premiums. It wrote domestic direct premiums of KRW 37.0 billion in 2022, up modestly from the previous year, while its overseas inward reinsurance premiums increased by over 15% to KRW 22.0 billion. The domestic direct business is expected to grow in line with the ongoing construction of nuclear reactors. Internationally, demand for reinsurance capacity in the nuclear insurance market is expected to increase as the Protocols to Amend the Paris Convention on Nuclear Third Party Liability, one of the international treaties on nuclear liability, entered into force as of January 1,2022, allowing wider coverage and a higher limit of liability for those who suffer losses resulting from an accident in the nuclear energy sector. This is likely to drive premium growth in our overseas nuclear business in the coming years.

At the same time, there has been a dramatic increase in premium rates for overseas accounts, especially in European countries, due to the impact of inflation and the Revised Paris Convention taking effect.

As a provider of specialist insurance coverage for the nuclear industry, KAEIP will remain committed to supporting nuclear operators in terms of insurance capacity and risk management services. In addition to ensuring that stable insurance capacity is provided domestically, it will also keep exploring new growth opportunities across the globe by staying responsive to market dynamics. Korean Re will play a leading role in these endeavors alongside KAEIP.

Global Reactor Status by Region

Gross Written Premiums: Korea Atomic Energy Insurance Pool (KAEIP)

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| Domestic Direct | 37.0 | 28.5 | 35.7 | 31.1 |

| Overseas Reinsurance Inward | 22.0 | 16.9 | 19.2 | 16.7 |

| Total | 59.0 | 45.4 | 54.9 | 47.8 |