The year 2022 presented a challenging business environment for reinsurers, and was marked by numerous natural disasters worldwide. Hurricane Ian made catastrophic landfall in Florida, resulting in an insured loss of USD 52.5 billion and becoming one of the costliest storms in history. Two separate drought events in the United States and Europe generated insured losses of USD 11.0 billion. Overall, total insured losses from natural catastrophes amounted to USD 132 billion in 2022, slightly lower than the previous year’s figure of USD 146 billion. This made 2022 the third consecutive year in which losses exceeded USD 100 billion.

The insurance and reinsurance industry also faced various economic and market challenges, including high inflation, interest rate hikes that eroded capital positions, the worst stock market performance since 2008, and foreign exchange rate fluctuations. Amid these economic headwinds, the reinsurance market continued to harden, with the most significant premium increases occurring in commercial property lines. While casualty insurance lines were not as directly impacted by inflation as property lines, rising medical expenses and indemnity costs still created cause for concern.

In 2022, our international treaty business written by the head office recorded a 16.8% increase in gross written premiums, totaling KRW 1,078.1 billion (USD 829.4 million, an increase of 3.2%). We achieved our target premium volume by securing solid market growth in various regions, including the Middle East, the Americas, and East Asia, demonstrating a well-balanced and steady expansion.

The current diversified international treaty portfolio reflects our commitment to serving clients globally. We have continued our efforts to optimize our business portfolio by region and prepare for the impact of catastrophes and large risk losses.

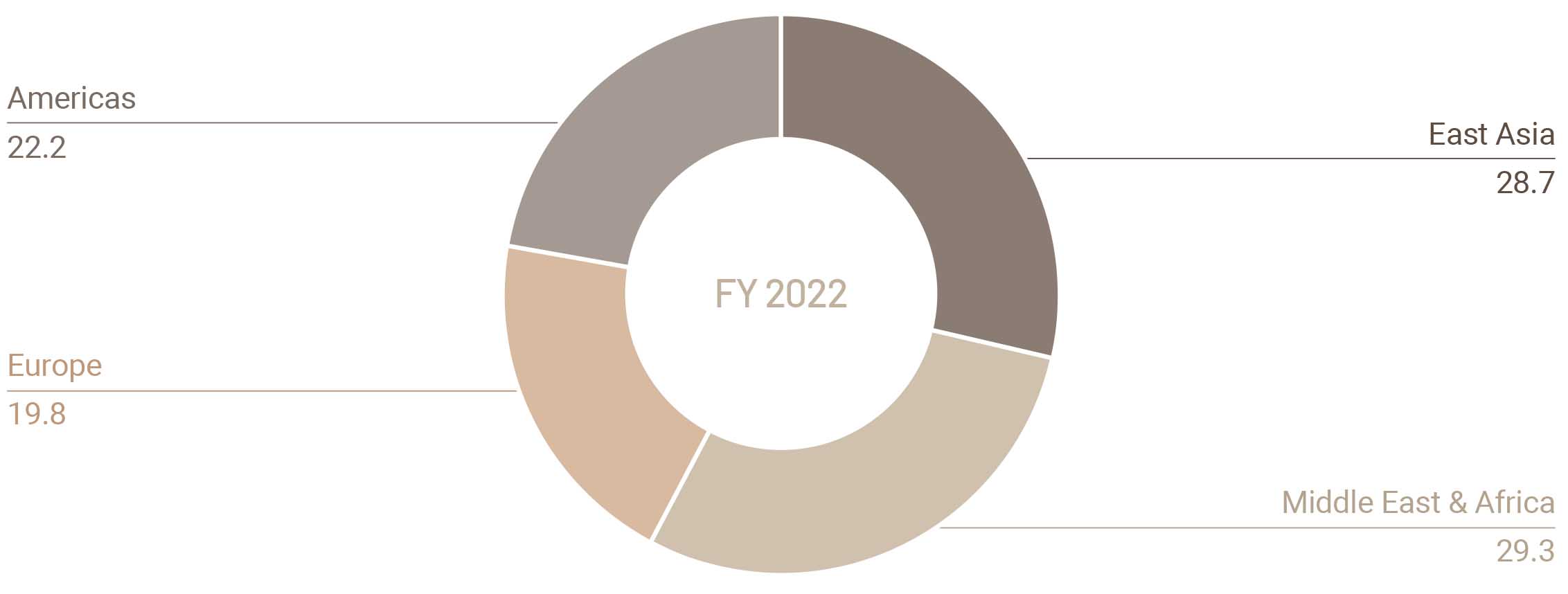

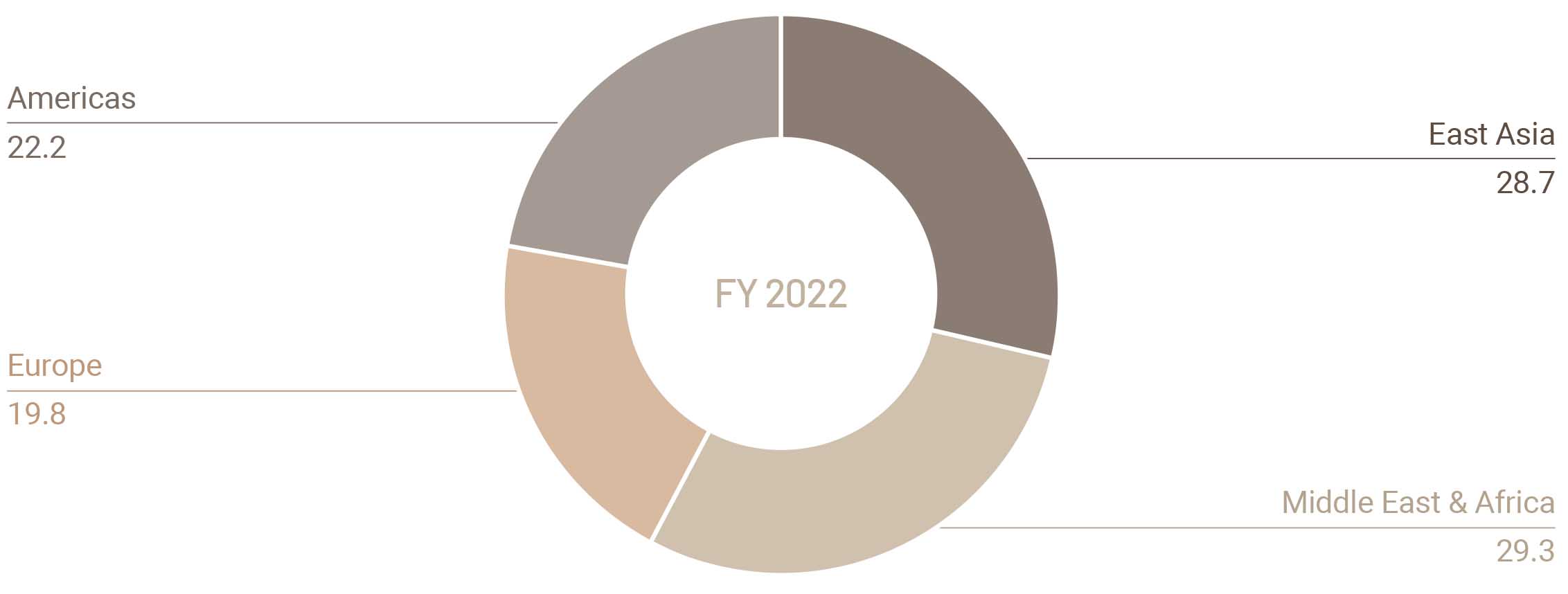

Notably, our property, engineering & marine portfolio has comparable shares of 29.3% for the Middle East & Africa and 28.7% for East Asia, with the Americas and Europe following closely at 22.2% and 19.8%, respectively. In terms of the casualty & motor business, the Americas & Asia account for 41.3%, while Europe & the Middle East make up 58.7%.

Despite ongoing uncertainty regarding natural disasters and economic challenges, we will maintain our current underwriting strategy, which is aimed at achieving sustainable growth in our target regions. We are also exploring various options in both the traditional reinsurance market and alternative capital market to reduce the impact of loss volatility resulting from global climate change and regional business environment changes.

International Treaty Portfolio by Region in 2022

(Property, Engineering & Marine)

(Units: %)

International Treaty Portfolio

by Region in 2022

(Property, Engineering & Marine)

(Units: %)

Gross Written Premiums: International Treaty

Property, Engineering & Marine

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| East Asia | 175.8 | 135.3 | 173.3 | 150.8 |

| Middle East & Africa | 179.6 | 138.2 | 136.9 | 119.1 |

| Europe | 121.4 | 93.4 | 114.4 | 99.6 |

| Americas | 136.0 | 104.6 | 109.9 | 95.6 |

| Total | 612.8 | 471.5 | 534.6 | 465.1 |

✽ Individual figures may not add up to the total shown due to rounding.

Casualty & Motor

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| Americas & Asia | 192.3 | 147.9 | 170.3 | 148.2 |

| Europe & Middle East | 273.0 | 210.0 | 218.5 | 190.1 |

| Total | 465.3 | 358.0 | 388.8 | 338.3 |

✽ Individual figures may not add up to the total shown due to rounding.

Gross Written Premiums: International Treaty

Property, Engineering & Marine

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| East Asia | 175.8 | 135.3 | 173.3 | 150.8 |

| Middle East & Africa | 179.6 | 138.2 | 136.9 | 119.1 |

| Europe | 121.4 | 93.4 | 114.4 | 99.6 |

| Americas | 136.0 | 104.6 | 109.9 | 95.6 |

| Total | 612.8 | 471.5 | 534.6 | 465.1 |

✽ Individual figures may not add up to the total shown due to rounding.

Casualty & Motor

(Units: KRW billion, USD million)

| FY 2022 (KRW) | FY 2022 (USD) | FY 2021 (KRW) | FY 2021 (USD) | |

| Americas & Asia | 192.3 | 147.9 | 170.3 | 148.2 |

| Europe & Middle East | 273.0 | 210.0 | 218.5 | 190.1 |

| Total | 465.3 | 358.0 | 388.8 | 338.3 |

✽ Individual figures may not add up to the total shown due to rounding.